Do You Need To Be Vat Registered To Invoice A Dutch Company For Consulting Services?

The VAT is a tax payable by companies in the Netherlands, whether they are resident businesses or foreign entrepreneurs. Well-nigh every company is bailiwick to this tax and it applies to the sales price of the products and/or services they offer to clients.

Facts about the VAT registration procedure in the Netherlands

A company in holland is required to register with the Commercial Register of the Sleeping accommodation of Commerce (CoC), in order to appear equally a VAT payer in the Netherlands, as well as for other fiscal duties. This applies to any blazon of legal entity such as a private limited company, limited liability company, clan or foundation. The registration with the CoC is also required for a partnership (such as a full general partnership) and for a sole proprietorship. For the registration with the Commercial Annals, there must be paid a one-time registration fee in amount of EUR l.

Some important facts near the VAT registration in kingdom of the netherlands are highlighted below by our team of Dutch lawyers:

- eligibility: the Dutch Taxation and Community Administration makes a special assessment for VAT eligibility; entrepreneurs may be liable for VAT purposes and non the income tax;

- usage: the VAT number issues once the Dutch Commercial Annals completes the registration procedure will be indicated on all of the issues invoices.

- calculation: the VAT is calculated on the price and costs of the provided appurtenances and services.

- exemption: some goods and services in the Netherlands are exempt from VAT, examples including services for childcare.

| Quick Facts | |

|---|---|

| We offer VAT registration services | Yes |

| Standard rate | 21% |

| Lower rates | 0%, 9% |

| Who needs VAT registration | All VAT payers (all those engaging in VAT-taxable activities) |

| Time frame for registration | Approximately 10 days |

| VAT for real estate transactions | Belongings sale and letting exempted from VAT in certain cases |

| Exemptions available | Education, childcare and healthcare services |

| Catamenia for filing | Within ane month after the report flow |

| VAT returns support | Yes, upon request |

| VAT refund | Simply in some cases for goods or services used for business organisation purposes |

| Local tax agent required | Reccomended |

| Who collects the VAT | The Dutch Tax and Community Administration |

| Documents for VAT registration | The Dutch Revenue enhancement and Customs Administration receives the details for registration from the netherlands Chamber of Commerce once the company is entered into the Dutch Business Register |

| VAT number format | NL + 9 digits + B + 2 check digits |

| VAT de-registration situations | When the company is deregistered from the Sleeping accommodation of Commerce |

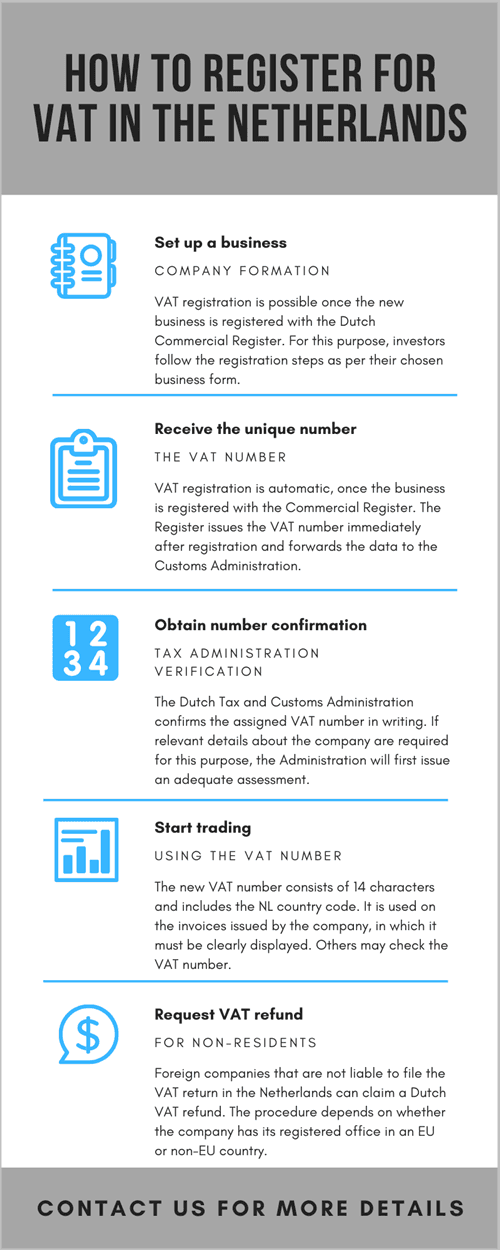

What is the process for VAT registration in Netherlands?

One time the Dutch company is subscribed to the Merchandise Register, the Commercial Sleeping room automatically transfers the company information to the tax regime.

At the same time, your visitor is subject to VAT registration in Netherlands. The VAT number in the Netherlands is issued immediately upon registration with the Chamber of Commerce for sole proprietorship and within five working days for other forms of business: partnership, limited liability company, corporation and other.

Once you registered for VAT in the netherlands and received the VAT number, there is some data nearly this revenue enhancement number y'all demand to know: the VAT number consists of xiv characters: the country lawmaking NL, followed by the Partnerships Legal Information Number (RSIN) or the Citizen Service Number (BSN), plus a iii digit lawmaking between B01 and B99. As you are registered for VAT in the Netherlands, the tax regime mention the company's VAT number on the letters and forms receive. In some forms, the tax authorities use the tax number, which is almost the same equally the VAT number, but information technology has no state lawmaking. Later on the registration with the Trade Register, the CoC number is issued and, every bit a legal entity or joint venture, at that place volition likewise be issued a number of Entities and Collaboration Information (RSIN). Moreover, each branch of the company will receive a unique establishment number of 12 digits.

One of our tax lawyers can provide investors with more than data near VAT registration in Netherlands in 2022.

How long does it take to obtain a Dutch VAT number?

The registration for VAT in the netherlands takes maximum v days. It should be noted that companies interested in conveying out trading activities outside the Netherlands will exist required to apply for an EORI number with the Tax Administration and Customs Part.

Dutch VAT invoicing requirements

Foreign and local citizens and companies applying for a VAT number with the Dutch authorities volition have the obligation of displaying this number on each invoice they issue. They are also required to file VAT reports with the local tax office. All invoices must comprise specific information about the VAT, amongst which:

- the client's VAT number;

- the seller's VAT identification number;

- a description of the goods/services sold;

- the net amount subject to VAT;

- the VAT rate;

- the amount due equally a VAT;

- the amount with the VAT included.

Information technology is also important to notice that upon company dissolution, a Dutch business will also be de-registered with the tax role and its VAT number will be deleted. A notification will be issued by the tax authorities in this sense.

What is the VAT for foreign entrepreneurs in holland?

Whenever strange investors provide goods and services in the country, their activities are also covered by the VAT laws in the country. The foreign investors must not only calculate and pay the revenue enhancement simply also make the necessary written report submissions. In some cases, a VAT deduction claim tin can be fabricated. These refunds may be claimed when the applicant complies with a set of conditions. Amongst these, our attorneys in kingdom of the netherlands list the following: the utilize of the goods and services was for business and not personal purposes and the utilise of the said appurtenances and services was for activities that are field of study to VAT application.

The claim refund will only exist taken into consideration when the applicant is non required to file a Dutch tax render, the VAT has been charged to the applicant and the VAT is deductible as an input tax for the applicant. The claimed corporeality must be at least 50 euros per calendar yr (other minimum amounts tin can apply). For businesses in the food and drink catering sector, the VAT cannot exist deducted.

When a business supplied appurtenances and services in holland and it is not subject to the Dutch VAT, the VAT charge per unit will normally be reverse-charged to the client. This is the case when the client is another business with a permanent establishment in holland or when information technology is a company (legal entity) that has been established in the country as per the usual visitor registration laws. When a foreign entrepreneur with appurtenances in a Dutch metropolis supplies these said goods to a client with an institution or permanent establishment in the Netherlands, the strange entrepreneur will issue an invoice that will include the fact that VAT has been opposite charged in that example. Our team of Dutch lawyers tin can provide strange investors in the Netherlands with more information on opposite charging on services and goods.

In some situations, taxpayers can object to a decision made by the Tax and Community Administration. 1 of our lawyers in kingdom of the netherlands can aid those who are confronted with this submit a letter of the alphabet of objection (within the six-calendar week catamenia). The decision issued by the Administration tin can exist appealed. One of our lawyers can help yous with more data nearly objecting these decisions.

Claiming the VAT refund in the netherlands

Companies that purchased goods every bit per their business purposes or that incurred other business-specific costs can claim a VAT refund. This procedure differs based on whether or not the business is based in an EU or a non-Eu country (equally seen in a higher place, non-resident companies tin apply for these refunds).

Beneath, our lawyers who specialize in VAT registration in the Netherlands draw the ii situations, based on where the company is incorporated.

When the company is established in an Eu country, a VAT refund may be claimed over the past five years. This asking is made in a digital form to the tax authorities in the Eu country in which the company is based. The submission deadline is Oct 1st in nearly countries in the European Union. However, we recommend verifying this engagement as the VAT asking is no longer valid after this date. When an entrepreneur submits the refund asking, the taxation government in the land where it was submitted forrard it to the Dutch Tax Department. In turn, the Department forwards the confirmation of receipt to the email address provided by the entrepreneur. In most cases, the conclusion for the refund is communicated within four months from the submission engagement. In some cases, this may differ. When the answer is a positive i (pregnant that the refund was approved), the Dutch Tax Department is to pay the amount within 10 days. When more than information is required for the assessment of the applications (for instance, non all of the documents are submitted with the initial awarding), this period may differ and in turn, the payment may be postponed.

When the business is incorporated in a non-EU state, the business owns needs to fill in a special form for the registration of foreign business aid. This step also includes a questionnaire that determines if the application may exist filed immediately or if the business also needs to apply for a VAT number in the Netherlands or a registration number. When filing a VAT refund asking, the business must too include the following documents: an entrepreneurship statement from the tax administration in the country of origin, the original invoices every bit well as relevant import documents. Companies in a not-EU land, for example, the Us, can submit a VAT refund request for up to five years after e year in which the business concern was charged for VAT purposes. Even so, entrepreneurs should be aware that when they claim the return for the years 2013-2016 they do non have the right to appeal to the courts against the decision issued by the Dutch tax authorities. One of our lawyers can provide more details.

Entrepreneurs who are interested in finding out more information about VAT returns and how they can make the refund calculation, as well as other calculations, can reach out to our taxation lawyers in holland. We can as well provide more details nigh the VAT number in the Netherlands, in addition to the details already mentioned in this commodity.

We invite you to watch a brusque video on VAT registration in the netherlands:

What are the VAT rates in the Netherlands in 2022?

The Revenue enhancement and Customs Assistants in the Netherlands imposes different value-added tax rates, co-ordinate to the types of services. these are the following:

- 21%: this is the general tariff applicable to most of the services provided by Dutch companies.

- 9%: this depression tariff applies to nutrient and drinks, agricultural products and services, medicines, daily newspapers, magazines and other common products and services,

- 0%: this mainly to the supply of goods from the netherlands to another land in the Eu; it besides applies to the international transport of passengers.

In some industries and for sure activities, you are exempt from VAT and you volition not accuse this taxation, for instance, collective interests, composers, writers, cartoonists and journalists, financial and insurance services, fund-raising activities, healthcare, gambling, childcare, instruction, radio and television, sports organizations and sports clubs. An agricultural scheme applies to market gardeners, livestock farmers as well as foresters in the netherlands. The goods and services supplied by business owners in these fields is too subject to the VAT exemption. One of our Dutch lawyers can provide more details about this authorities and, in general, almost the appurtenances, services, and professions that are subject to the VAT exemption.

Digital services are subject to different VAT rules, meaning that they are taxed in the state of the client (where he lives or where he is established). These types of services refer to telecommunication, broadcasting and electronic services. One of our lawyers in the Netherlands can provide more details on the types of services covered past these taxation rules.

VAT is also applicable to immovable property in the Netherlands. There are three cases when this tax applies, namely when an possessor sells property, when he lets property or when he lets a holiday home. In the instance of a auction, this applies when the purchaser is a private private or a strange entrepreneur or when the purchaser is an entrepreneur who is established in kingdom of the netherlands. VAT is payable upon the same of a building or a part of a building with state inside two years of its first occupation. For letting immovable holding, VAT applies for letting hotels, guesthouses, campsites, parking lots, mooring and storage places for vessels and in other situations. Homeowners who are frequently letting their holiday homes may exist treated as an entrepreneur for VAT purposes, in instance this happens oftentimes. When the vacation home is merely purchased for private use, the revenue enhancement is not applicable, however, whenever the home is permit to guests directly or through intermediaries, the activity will be charged.

One of our attorneys in the Netherlands can provide more details virtually the situations in which VAT is applicable for selling or letting immovable property also as for the use of a holiday home. In most cases, still, these activities related to the property are exempted from VAT.

If yous desire to open a company in the Netherlands and need assistance with the incorporation procedure, we can assist with it. Nosotros tin can also aid with the VAT registration in Netherlands.

Calculating the VAT in holland

Once the VAT registration is completed, the computation of the tax must be made in accordance with the requirements imposed by the Taxation and Customs Administration in holland. The VAT is calculated based on the total amount of coin charged on the customer which must include the value of the products, the delivery, the packaging and other costs. It is important to note that the depositing of goods is exempt from the VAT in the Netherlands.

Special attention must be paid upon the charge of the VAT for imports from EU and non-EU countries. Given the fact that the Netherlands is an Eu fellow member country, the EU intra-Community acquisition regulations apply, case in which the VAT will be charged in accordance with the VAT imposed past the supplier. When the amount of money is not in euros, it must exist exchanged.

When importing goods from a non-EU country, the VAT volition be calculated by the Dutch Customs Assistants. If the corporeality of money on the invoice is not in euros, the corporeality will be converted into euros on the import announcement.

What are the VAT reporting requirements?

VAT registration in Netherlands is mandatory, all the same, the obligations of the entrepreneur practise not stop with this step. They are as well required to file VAT returns and pay the applicable VAT rates according to the police force in force and by observing the terms. VAT returns are filed on a monthly, quarterly or annual basis, depending on the amount of VAT that is to be paid. When the VAT return is filed for the first time, the applicant is required to enclose all of the original invoices. The Dutch authorities have the right to inspect the tax return and may ask for boosted documents, such as copies of the issued invoices or the import documents, in add-on to the original invoices for purchases that are usually required.

Foreign investors in the Netherlands may appoint a taxation representative who will handle the requirements fix along past the Tax and Customs Administration. Working with a tax representative is mandatory when the entrepreneur wishes to apply the reverse accuse mechanism on import. Having a representative does not mean that the business owner is not liable for taxation purposes. The main requirements for a revenue enhancement representative are that he must be based in the land and he must offer financial security for the VAT. His main duties are filling in the VAT return, filling in the intra-community transactions statement and applying the opposite-charge mechanism on imports.

If you wish to open a company in kingdom of the netherlands in 2022 and demand more details on the VAT requirements, please fee freel to reach out to our team of tax lawyers. We can provide help for VAT registration once the company registration is complete as well equally ongoing reporting assistance so that you lot tin can residuum assured that your company complies with the requirements for VAT reporting. Nosotros can also provide investors with details on the Taxation Plan bundle issued by the Authorities.

Boosted information for the use of the VAT number in holland

VAT deregistration in kingdom of the netherlands is closely linked to the visitor'southward registration condition with the Bedroom of Commerce (KVK). When the company is deregistered from the Sleeping room, information technology will also be deregistered from the Tax and Customs Administration. This is an automatic process that volition atomic number 82 to the termination of the VAT number. The process is to be notified to the entrepreneur via a written confirmation.

Investors should know that all companies in the Netherlands are required to use the new VAT identification number starting with January 2020. The new number was introduced in order to offer a greater level of protection for entrepreneurs who are doing business in the country. The usage of the new number is important for the VAT returns issued starting with this appointment. Moreover, any requests for cross-border VAT refunds are to exist issued by using the new VAT number in the Netherlands in 2020. New VAT identification numbers can be verified online, using the VIES platform. One of our lawyers can provide more details.

Nosotros too remind investors that EORI registration in Netherlands is required for the purpose of engaging in trading activities in and outside of the European union in 2022.

Company formation in the Netherlands is bonny for many entrepreneurs because of not only the favorable business regime and incentives for companies but besides because of the state's favorable location within the Eu. According to Statistics Netherlands, the following numbers were recorded in regards to the investment climate in the country:

- 5.65% growth: the book of investments in tangible fixed assets grew in October 2019 compared to the same month in 2018.

- 2.9: the indicator of the manufacturer's confidence in Dec was upwards from two.eight in November 2019.

- 119 bn EUR: the value of the domestic appurtenances exports and 99 bn EUR service exports from the Netherlands 2017.

Contact our Dutch police force firm for further information and specialized support for VAT registration in Netherlands. We are able to provide you lot with a wide range of services on fiscal and legal support.

We tin can also help you with matters apropos private clients as nosotros offer complete assistance during divorce in Netherlands.

Do You Need To Be Vat Registered To Invoice A Dutch Company For Consulting Services?,

Source: https://lawyersnetherlands.com/register-for-vat-in-the-netherlands/

Posted by: miltenbergerinquen.blogspot.com

0 Response to "Do You Need To Be Vat Registered To Invoice A Dutch Company For Consulting Services?"

Post a Comment